In this context, the supplier has ceased to be a simple vendor and has become a strategic partner that co-creates value and shares risks. This analysis is led by Diego Hernández (1).

By Panorama Minero

From simple supplier to strategic partner

Mining operations are complex: extreme conditions, capital-intensive assets, high safety standards, and pressure for efficiency and sustainability. Against this backdrop, the traditional transactional approach - price and delivery - is insufficient.

Today, companies seek suppliers capable of understanding the operation, anticipating failures, and delivering end-to-end solutions. It is a relationship based on trust, communication, and commitment, where objectives align: optimize costs, improve productivity, reduce risks, and enable new technologies.

What a high-performing supplier contributes

The new profile of the mining supplier combines technical, digital, and management capabilities. Among the most valued contributions are goods and services designed for extreme conditions; solutions to optimize processes and reduce costs; consistent standards for quality, safety, and environmental performance; open innovation with research centers; and the use of digital technologies for monitoring and real-time decision-making, supported by a culture of continuous improvement and training.

Requirements to join the value chain

Being an eligible supplier to large-scale mining entails meeting requirements that go beyond a product catalog: risk management with contingency plans and adequate insurance; certifications and standards in quality, environment, and safety; and ethics and transparency through anti-corruption policies, codes of conduct, and traceability.

Added to this are flexible, collaborative contracting models - joint ventures, consortia, or other arrangements - that make it possible to share investments, technological risks, and benefits, especially in knowledge-intensive services.

Presence throughout the mining life cycle

Suppliers’ contribution spans from exploration through mine closure and post-closure: drilling, analysis, and modeling in early stages; design and provision of critical equipment and consumables for feasibility and construction; maintenance, logistics, safety, communications, catering, and accommodation during operations; and site restoration, revegetation, and environmental monitoring toward closure.

A supply chain in transformation

A few days ago I attended the Chilean Mining Chamber’s 2025 year-end meeting; there I confirmed that, even after more than 100 years of mining, supplier development and tangible benefits for local communities remain central on the agenda.

Supplier registries in provinces such as San Juan, Catamarca, or Santa Cruz show a diverse and expanding structure. This diversity is strength, but it demands greater coordination and integration. Mining companies no longer manage only isolated contracts, but supplier ecosystems that must be resilient to market shifts and logistical disruptions. In this framework, four trends are consolidating: sustainability (smaller footprint and more local content), collaboration (long-term alliances), digitalization (integrated data and traceability), and resilience (continuity and adaptation plans).

Trust, communication and commitment (beyond tax domicile)

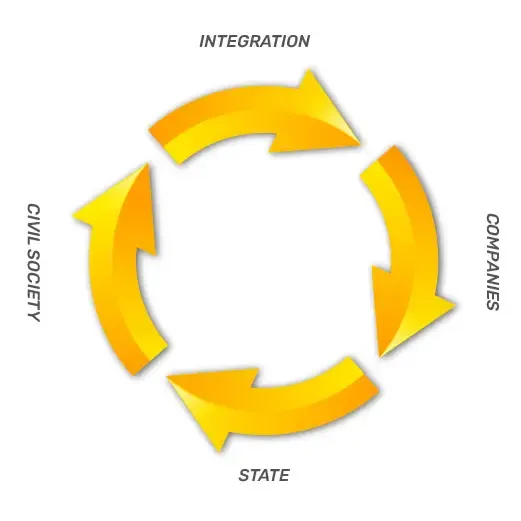

Figure 1. Continuous interaction scheme among the different actors in the mining value chain.

The major challenge is to deepen this paradigm shift: to move from a buy-sell logic to collaborative value management. In this context, the ability to transform and to be truly eligible as a strategic supplier will, in practice, carry far more weight than laws or bills that “force” mining companies to contract based on provincial incorporation.

It is not enough, on its own, to “be from San Juan,” “be from Catamarca,” or “be from Santa Cruz” to become the supplier that delivers sustainable value to the mine, to the local-regional community, and to the country. The challenges are demanding: they depend on investment capacity, the level of professionalization, technological adoption, and, above all, each supplier’s vision.

Being from the territory is a starting advantage, but it does not guarantee the outcome. The place each company will occupy in the mining value chain of the next decade will not be determined by its legal domicile, but by the combination of performance, reliability, innovation, and sustainability it can offer - and this is still true today in developed mining countries around the world, such as Canada, Australia, or Chile in South America.

Ultimately, supplier development in mining is not an operational topic but a strategic one: project continuity, production efficiency, the relationship with communities, and the industry’s future viability depend on it. This also requires permanent interaction and the building of agreements among all stakeholders involved: mining companies, suppliers, governments, communities, and the science-and-technology system. And it is built, day by day, on three simple but demanding pillars: trust, communication, and shared commitment.

(1) A mining engineer and business management specialist, ontological coach, and executive leadership coach, with an extensive professional career of more than 30 years in international companies across the industrial, banking, and mining services sectors. He has 20 years of experience in the explosives industry, leading the start-up of new international businesses, the construction of an emulsion plant, the implementation of safety programs and training programs, among other initiatives.