Uranium 2024: Resources, Production and Demand, publication issued in 2025, presents the most recent review of world uranium market fundamentals and provides a comprehensive statistical profile of the uranium industry. This analysis is led by Luis López (1).

By Panorama Minero

This publication includes 62 country reports covering uranium exploration, resources, production, and reactor-related requirements—48 prepared from officially reported government data and narratives, and 14 prepared by the secretariats of the Nuclear Energy Agency (NEA) and the International Atomic Energy Agency (IAEA). The report features projections for nuclear generating capacity and uranium requirements through 2050, as well as a discussion of long-term supply and demand issues.

The data reporting period for this edition of the “Red Book” spans 1 January 2021 to 1 January 2023 (calendar years 2021 and 2022), although some relevant information for 2023 and 2024 is also included.

Red Book 2024 – Key Findings

Sufficient uranium resources exist to support both the continued use of nuclear power and significant global growth in nuclear capacity for electricity generation, as well as emerging applications such as industrial heat and hydrogen production, through 2050 and beyond. Nearly 8,000,000 tonnes of recoverable in-situ uranium resources of economic interest have been identified (recoverable at < USD 260/kgU).

Recent years have shown that strong market signals drive significant investment in uranium exploration, with high potential for discovering new economically viable resources. However, several factors influence the likelihood and timing of bringing these resources into production. Some are located in jurisdictions currently unfavorable to uranium mining, while others lie in countries with limited experience in the sector; conversely, many are in mining-friendly jurisdictions. Political stability remains a critical factor: events since 2023 in Niger—home to nearly 6% of global identified resources—have already affected the country’s uranium industry. Some countries prioritize domestic uranium production to meet national demand, while others are established or aspiring global suppliers, such as Australia, Canada, Kazakhstan, Namibia, South Africa, and Uzbekistan. Around 17% of global identified resources are in the Olympic Dam deposit, where uranium is produced as a co-product, and production decisions are primarily driven by copper market conditions.

Uranium resources will be developed when market conditions provide confidence in long-term project value. Weak market conditions can delay new supply and slow investment in exploration, which may hinder the delineation of additional resources over time. Substantial unconventional uranium resources—such as those in phosphate deposits and black schists/shales—could further extend the timeframe during which nuclear energy can meet global energy needs using current technologies. Advanced reactor and fuel cycle technologies may also enhance the long-term uranium supply. For example, closed fuel cycles with recycling could extend the availability of nuclear energy from uranium fission for thousands of years.

Ensuring adequate uranium supply requires both producers and consumers to maintain the necessary framework conditions for exploration, mining, processing, and transportation. This includes pricing mechanisms capable of supporting long-term investment. A strong uranium market, characterized by sustained high prices, will be essential to developing resources in time to meet future demand—projected in this edition to more than double by 2050 in the high-demand scenario and to increase by 60% even under the low-demand scenario.

The uranium spot price, which was about USD 80/kgU in early 2021, rose to USD 130/kgU by early 2023 and continued to increase throughout 2023, peaking at USD 275/kgU in 2024 and remaining at around USD 200/kgU in 2025. The exploration, mine development activities, and production figures presented in this edition reflect the industry’s response to this improving market after a decade-long downturn. A rebound in exploration and project development is clearly underway, with several long-delayed projects approaching final investment decisions. Approximately half of the previously idled production capacity has been—or is being—returned to service, although the remaining idled capacity is expected to require considerably higher prices and may contribute less production.

Geopolitical tensions will continue to shape the uranium industry, strengthening supply security considerations and encouraging some nuclear-generating countries to build domestic inventories or prioritize imports from allied or neutral suppliers. Growing global attention to climate change and the need for substantial expansion of carbon-free energy generation have fuelled renewed support for nuclear power. This trend is likely to continue, underpinning a robust uranium industry with significant demand growth expected—particularly if the pledge made at COP28 by several countries to triple nuclear capacity by 2050 is fulfilled and if emerging applications, such as small modular reactors (SMRs), are widely deployed. As of 2025, 33 countries have enrolled in the initiative to triple nuclear capacity by 2050.

In conclusion, although sufficient physical uranium resources exist to meet both current and projected demand through 2050 and beyond, significant investment in exploration and new mining projects will be required to bring these resources into production in a timely manner. Sustained strong uranium prices will be necessary to enable the development of new production capacity, incentivize ongoing exploration to replace depleting resources, and support investment in research and development for cost-effective extraction from unconventional or low-grade deposits.

Joint NEA–IAEA Uranium Group (UG)

The general objectives of the UG are to coordinate the preparation of periodic assessments of the world’s natural uranium supply; examine the relationship between these supply capabilities and projected demand; foster the exchange of technical information on uranium resources, exploration, production technologies, environmental impacts, and environmental protection technologies associated with mining and ore processing, in cooperation with member countries and other relevant international organizations as appropriate; and recommend to the NEA and the IAEA actions that may be taken to ensure an adequate long-term supply of uranium for nuclear power development.

The 60th meeting of the UG was held in Vienna, Austria, from 10 to 14 February 2025, bringing together more than 50 experts from NEA and IAEA member countries. This milestone meeting offered a platform for in-depth discussions on the past, present, and future of uranium resources, supply and demand, alongside emerging challenges and technological advancements in exploration, production, and environmental protection.

During the meeting, experts presented updates on national uranium programs, recent developments in exploration and mining technologies, and environmental impacts and protection measures related to mining and ore processing. The agenda also included industry-focused presentations from leading uranium and nuclear fuel cycle companies and associations, offering valuable perspectives on how the sector is preparing to meet the growing global demand for nuclear energy.

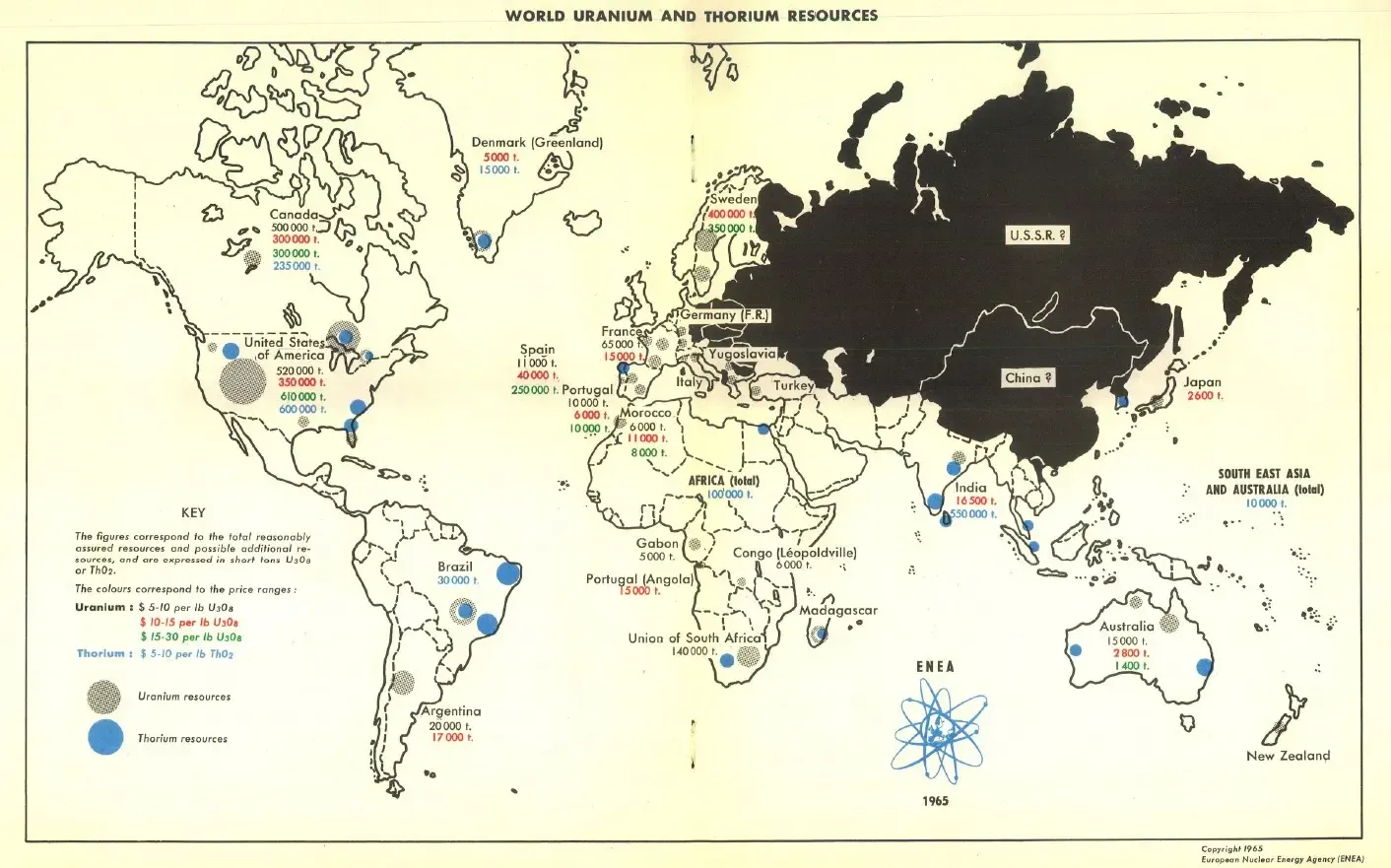

A key highlight was the celebration of the 60th anniversary of the Red Book, the world’s leading multi-government-sponsored reference on uranium, formally titled Uranium: Resources, Production and Demand. First published in 1965, this joint NEA–IAEA report has been instrumental in providing reliable data and analysis to support evidence-based decision-making by policymakers, industry stakeholders, and researchers.

Argentina has been present in the pages of the Red Book since its first publication in 1965 by reporting uranium reasonably assured resources and possible additional resources at that time. The existence of uranium resources has been critical for the nuclear development achieved by our country since the 1950s.

Sources:

https://www.oecd-nea.org/jcms/pl_101513/uranium-group-meeting-celebrating-60-years-of-the-red-book

https://www.oecd-nea.org/jcms/pl_103179/uranium-2024-resources-production-and-demand?details=true

(1) 40 years of experience in the nuclear sector, working at the National Atomic Energy Commission of Argentina (CNEA). Senior Advisor for the Nuclear Fuel Cycle, responsible for nuclear resource initiatives at both the national and international levels. Consultant for the International Atomic Energy Agency (IAEA). Vice President of the Board of the Nuclear Energy Agency (NEA)/Organisation for Economic Co-operation and Development (OECD)-IAEA Uranium Group. Vice President of the Board of the Group of Experts for Resource Management (EGRM) of the United Nations Economic Commission for Europe (UNECE) on behalf of the Latin American Mining Organization (OLAMI). Professor at the Balseiro Institute and the University of Buenos Aires (UBA)."