Argentina is strengthening its position as a mining powerhouse, backed by official data showing a world-class portfolio of natural resources. Lithium leads with nearly 200 million tonnes of estimated resources, followed by strategic reserves of gold, copper, and silver. These figures, taken from the updated technical report published in June 2025, are key to understanding the country’s growing relevance in the new global energy and technology order.

By Panorama Minero

The report, published by the National Mining Secretariat and titled “Mineral Resources and Reserves in Argentina”, was structured by geologist Magaly Quintrein. It summarizes the country’s geological potential based on public data from an estimated 80 advanced mining projects at various stages of development. This national mining portfolio includes lithium, gold, silver, copper, and uranium, and is built from technical reports, feasibility studies, NI 43-101 documents, and corporate presentations.

Mineral Resources and Reserves 2025: Key Figures

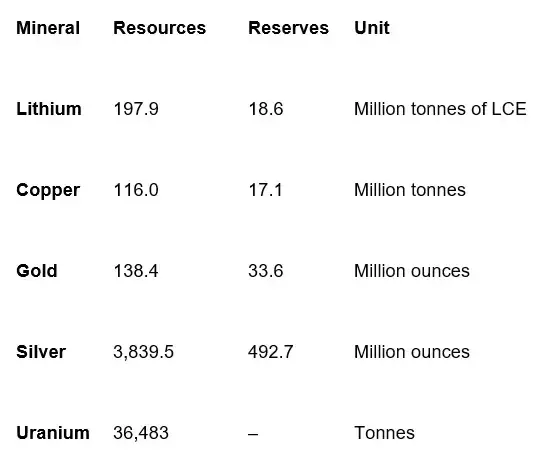

The report provides the following consolidated estimates:

These figures place Argentina among the global leaders in lithium and among the strategic players in copper, gold, and silver. In particular, the lithium segment includes 34 projects at various stages, many of them involving major international players such as Rio Tinto, Ganfeng, POSCO, Albemarle, Zijin, and Lake Resources.

Lithium: A Pillar of the Energy Transition

The most dynamic and geopolitically relevant segment is lithium—alongside copper. Argentina currently holds 197.9 million tonnes of lithium carbonate equivalent (LCE) in resources and 18.6 million tonnes in reserves. This mineral wealth is concentrated mainly in the provinces of Salta, Jujuy, and Catamarca, and includes producing projects such as Cauchari-Olaroz, Centenario-Ratones, Fénix, Mariana, Sal de Oro, Sal de Vida, and Olaroz.

Copper and Gold: Underdeveloped Strategic Assets

Although Argentina has not yet developed large-scale copper production, its copper portfolio is significant: 116 Mt in resources and 17.1 Mt in reserves, with flagship projects including El Pachón, Taca Taca, Josemaría, Mara, and Filo del Sol. These are joined by other advanced-stage developments that could drive multibillion-dollar investments.

In the gold sector, Argentina reports 138.4 million ounces in resources and 33.6 million in reserves, with active operations including Cerro Vanguardia, Cerro Negro, Veladero, Lindero, and Don Nicolás. Gold exports remain a key source of foreign exchange for provinces in the NOA and Patagonia regions.

Silver and Uranium: Strategic Mid-Term Assets

With 3,839.5 million ounces in resources and 492.7 million in reserves, Argentina’s silver portfolio includes standout assets like Navidad (Pan American Silver), considered one of the largest undeveloped silver deposits in the world.

As for uranium, the report estimates 36,483 tonnes in resources, spread across projects operated by CNEA, Blue Sky Uranium, Jaguar Uranium, and UrAmérica. While no reserves are reported in this edition, uranium remains a strategic mineral for national energy sovereignty and aligns with ongoing global announcements regarding nuclear development.

This mapping of resources and reserves is a critical tool for both public authorities and private investors. It brings transparency to Argentina’s existing mineral assets, provides a solid technical base for policymaking, and serves as a reference framework for evaluating long-term investment opportunities.

According to the official document, the data is sourced from over 40 public and technical references, including company reports, independent assessments, NI 43-101 filings, and investor presentations.