Latin America’s steel industry has issued a warning ahead of 2026. The combination of global oversupply, China’s expanding role in international trade and stagnating regional demand is creating a vulnerable environment for the steel value chain, with implications extending beyond the sector to the broader industrial base.

By Panorama Minero

According to the Visión 2026 report by the Latin American Steel Association, ALACERO, the region reached a turning point in 2025, marked by a record inflow of imported steel products and finished goods incorporating steel, often priced below local production costs.

“Overproduction and the growing influx of products from China and other Southeast Asian countries have reached unprecedented levels, with exports at artificially low prices supported by subsidies,” said Ezequiel Tavernelli, Executive Director of ALACERO.

China and an Unprecedented Global Distortion

China’s weight in the global steel market has no historical parallel. According to the report, the country accounted for 52% of global production in 2025, totaling 960.8 million tonnes, and produces in 17 days what Latin America manufactures in an entire year.

Chinese exports of rolled and semi-finished steel increased 181% between 2020 and 2024, rising from 42 million to 117 million tonnes. In 2025, exports reportedly reached nearly 134 million tonnes, despite weaker domestic demand.

“The debate is not limited to a single sector but involves the entire industrial fabric of the region,” Tavernelli noted. Competitive pressure affects not only steel plants but also the automotive, home appliance, machinery and construction materials industries.

The Risk of Silent Deindustrialization

ALACERO argues that the impact is already visible in structural indicators. Over the past 35 years, manufacturing value added in Latin America declined from 19% of GDP in the 1990s to 15% in the 2010–2024 period.

“Behind every displaced tonne there are quality jobs, postponed investments and productive capacity at risk of being permanently lost,” Tavernelli said, in line with OECD assessments identifying critical conditions in the regional steel industry.

Currently, more than 40% of steel consumed in Latin America is imported, excluding steel embedded in finished goods. In 2025, the trend intensified with a significant rise in imports of manufactured products.

Automobile imports increased by nearly 60% year-on-year across the region, excluding Mexico. Machinery imports rose around 110%, and home appliance imports surged 170%, partly influenced by trade liberalization in Argentina.

Weak Demand and Mixed Signals Toward 2026

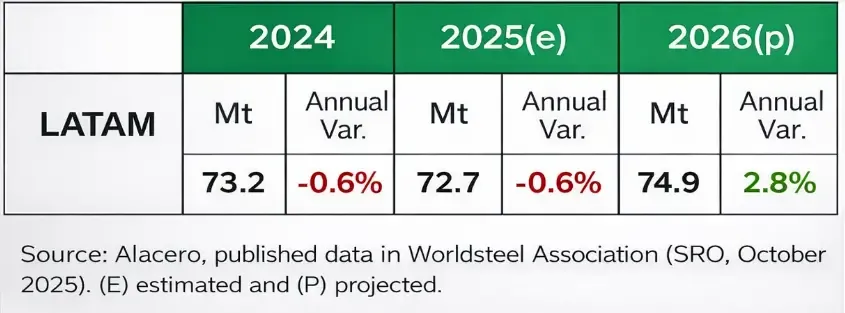

Alongside rising imports, regional steel demand showed a fragile performance. In 2025, apparent steel consumption, ASU, declined by 0.6%, marking a second consecutive drop and standing 3.2% below the peak recorded in 2021.

Construction, which accounts for nearly 50% of total steel demand, remained largely stagnant. Regional manufacturing output grew 0.7%, less than half the pace of GDP expansion.

For 2026, ALACERO projects apparent consumption growth of 2.8%, reaching 74.9 million tonnes. The recovery is associated with partial improvement in Mexico, continued rebound in Argentina and stronger demand in Brazil and Colombia.

The report notes that the outlook remains conditioned by global uncertainty, trade tensions and sustained pressure from Asian imports.

Defending the Value Chain

In response, ALACERO calls for a comprehensive strategy combining trade defense instruments, industrial policies, energy efficiency improvements and coordination among governments, companies and workers.

“Global trade rules were not designed for a state-subsidized export strategy or for the distortions it generates,” Tavernelli stated, citing OECD data indicating that subsidies to China’s steel industry significantly exceed levels observed in developed economies.

The association highlights that Latin America has one of the lowest carbon footprints in steel production globally and possesses natural resources and industrial capabilities relevant to sustaining its value chain.

Looking toward 2026, the sector warns that without coordinated and modern responses to global excess capacity and import pressure, the region’s industrial base could further weaken.