Glencore has confirmed that it is engaged in preliminary discussions with Rio Tinto “regarding a possible combination of some or all of their businesses, which could include a merger by way of a share exchange between Rio Tinto and Glencore. The parties’ current expectation is that any merger transaction would be carried out through the acquisition of Glencore by Rio Tinto via a court-sanctioned scheme of arrangement.”

By Panorama Minero

Glencore’s statement further notes: “There can be no certainty that the terms of any transaction or offer will be agreed, nor as to the terms or structure of any such transaction or offer should agreement be reached.”

With operations spanning dozens of countries across all five continents, Glencore and Rio Tinto share two key regions in common: South America and Australia. South America, in particular, carries significant weight given the copper footprint in Argentina, Chile, and Peru, as well as the lithium developments in Argentina’s Northwest (NOA) region.

An Analysis of Glencore and Rio Tinto

Copper, a Decisive Commodity

Glencore is one of the world’s leading copper producers. Company projections place it among the top five global players, surpassed only by Codelco, BHP, and Freeport.

At present, Glencore’s copper production—totaling 950,000 tonnes in 2024—comes from a diversified portfolio of operations in Chile, Peru, Australia, and the DRC (Democratic Republic of the Congo). In the DRC, cobalt emerges as a significant by-product, positioning Glencore among the world’s top three producers of this metal.

Of particular note is Glencore’s announcement in early December regarding the restart of operations at Bajo de la Alumbrera. Located in Argentina’s Catamarca Province, this project produced copper for more than 20 years until 2018, when it was placed under care and maintenance.

Rio Tinto, for its part, reported lower copper production, with approximately 624,000 tonnes in 2024. The Anglo-Australian company’s copper operations are located in Chile, the United States, Mongolia, and Australia.

Both companies are present in some of the world’s most important mining districts. In Glencore’s case: Collahuasi (Chile), in a joint venture with Anglo American; Antamina (Peru), in a joint venture with BHP.

For Rio Tinto: Escondida (Chile), in a joint venture with BHP; Oyu Tolgoi (Mongolia); Northparkes (Australia).

Lithium, Rio Tinto’s Latest Major Bet

Following the acquisition of Arcadium Lithium for approximately US$6.7 billion, Rio Tinto has become one of the leading players in the lithium market, surpassed only by Albemarle, Ganfeng, Tianqi, and SQM.

Rio Tinto’s Lithium business unit has a presence in the Argentine provinces of Catamarca, Jujuy and Salta through several projects: Fénix and Sal de Vida Hombre Muerto; Cauchari and Olaroz in the Olaroz salar; and Rincón, in the salar of the same name. The portfolio combines operating assets with others at advanced stages of development.

Leaders in Other Metals

Rio Tinto is the world’s second-largest iron ore producer, with operations in Western Australia, trailing only Vale. The company has also consolidated its position as a top-tier producer of aluminum and diamonds—ranking in the global Top 3 for both—through operations in Australia and Canada.

Glencore ranks among the world’s top five nickel producers, with mines in Brazil, Canada, Indonesia, and New Caledonia. In zinc, it is the global leader, supported by operations across South America, Australia, and Kazakhstan.

Glencore and Rio Tinto – RIGI Filings and Argentina’s Outlook

Recently, Glencore announced a reconfiguration of its business structure, creating a unit named Copper Argentina, clearly underscoring the strategic importance of Argentina’s copper resources within the portfolio of one of the world’s leading diversified mining companies.

In addition to the restart of Bajo de la Alumbrera, two major projects rank among the world’s Top 10 largest undeveloped copper deposits: Agua Rica and Pachón. Their applications under Argentina’s RIGI investment framework were submitted last August, with projected investments of US$4 billion and US$9.5 billion, respectively.

Agua Rica is expected to have a mine life of 23 years, with average annual production of 204,000 tonnes. Located in Catamarca Province, the project stands to benefit from existing infrastructure—processing facilities, rail transport, and more—at nearby Bajo de la Alumbrera.

Pachón, located in Calingasta Department, San Juan Province—home to several major copper projects—envisions a mine life exceeding 40 years, with annual production of approximately 185,000 tonnes of copper.

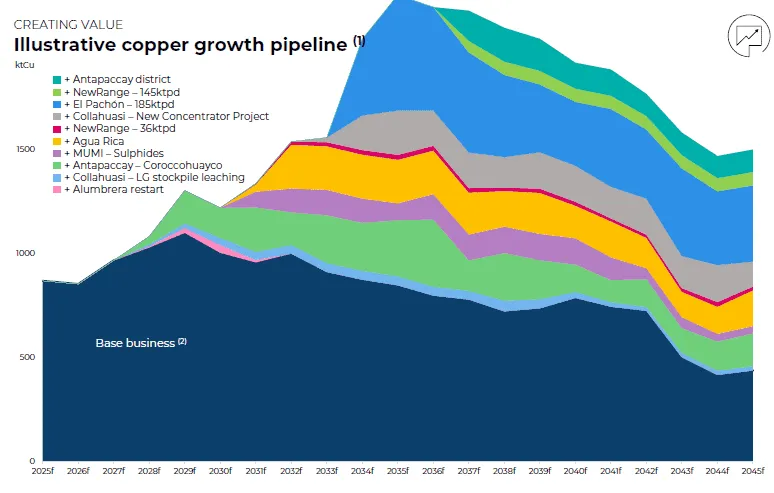

The scale and significance of Glencore’s Copper Argentina unit are illustrated in a chart presented by the company last December, showing annual production projections from 2025 through 2045.

Rio Tinto has also submitted its lithium projects under the RIGI framework. Rincón, with an investment of US$2.8 billion, has already received approval, while Sal de Vida, valued at US$635 million, remains under review.

Although lithium is Rio Tinto’s primary focus in Argentina, the company also has a presence in copper through its technology subsidiary Nuton, which holds an interest in the Los Azules project—also located in Calingasta—where a US$2.7 billion RIGI application has already been approved.

Argentina and Copper: The Winning Card in a Potential Merger?

Together with iron ore, copper would represent one of the two core business pillars of the combined entity. As one of the world’s largest corporate groups by market capitalization, the merged company could become a leading global copper producer, potentially surpassing several of today’s top players.

In this context, it would control two major undeveloped copper mines—Agua Rica and Pachón—along with a strategic presence in another advancing project, Los Azules.

On a smaller but still highly significant scale, the new organization would also stand as a major global lithium player, with a firmly consolidated position.

Rio Tinto has until February 5 to formalize an offer or withdraw from the potential combination. This year could witness one of the largest corporate mergers ever seen in the global mining sector—one in which Argentina’s copper and lithium assets would play a more than prominent role.